The recent referendum in the UK and the resulting vote to leave the European Union is creating a significant level of uncertainty across the globe. Based on previous high profile and often large impact events, clearly there is a tendency to curb or stop discretionary investments, including non-essential IT investments and projects, very quickly in these types of situation.

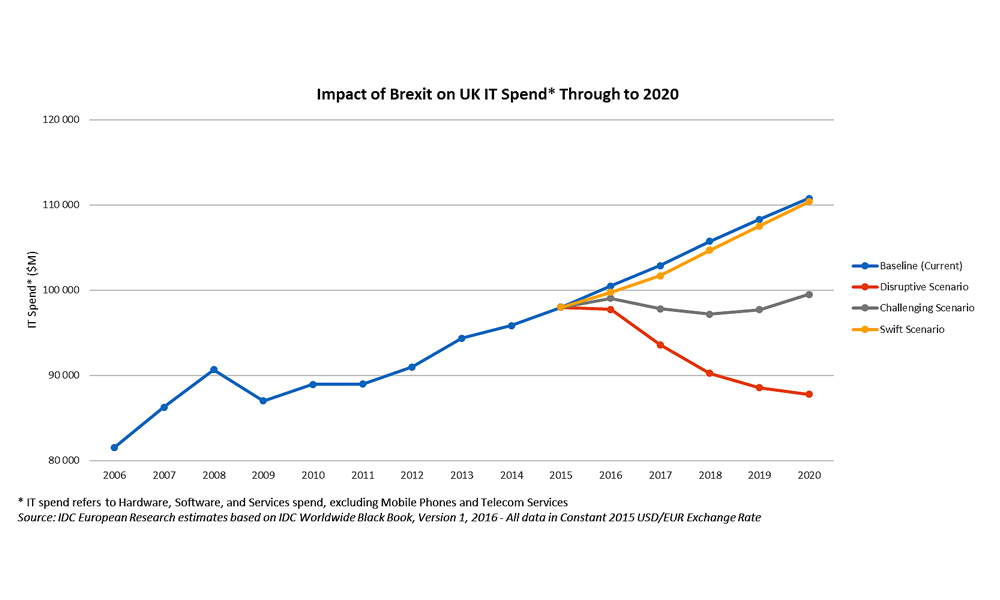

IDC expects a challenging transition as a result of Brexit, with the UK IT spending forecast likely to be revised downwards by more than 2% on a compound annual growth rate basis through to 2020, but with overall European IT spending remaining largely unaffected in this period.

“The often dramatic experiences in the past decade have enabled leaders across the globe to establish risk processes and act in a more measured fashion. Based on recent feedback from a number of large enterprise leadership teams, we expect a wait and see approach as the political and economic lines are redrawn,” said Thomas Meyer, Group Vice President Research at IDC Europe. “IT spending will likely shift, but the strategic transition towards the digital enterprise will remain, and in fact is likely to accelerate with a greater focus on cost optimisation and IT value to the organisation’s bottom line.”

“Given the uncertainty in the market, we believe the framework that we have put in place will help companies work through the next few months for their short-term business planning purposes,” said Philip Carter, Chief Analyst IDC Europe. “This involves three scenarios with concrete assumptions linked to GDP growth, skills access, regulation tariffs, exchange rates, infrastructure, market confidence and obviously IT spend. We are also assuming that 2Q and 3Q IT spend in 2016 was, and will be, adversely affected by the uncertainty directly before and shortly after the poll.”

Below are the three scenarios that IDC currently foresees in terms of the potential impact of this major event on IT spending in the UK and Western Europe.

#1 Challenging transition with 70% probability

The scenario would see a downward drop in UK GDP at first, but a new relationship is set up in some form of bilaterally negotiated agreement in the medium term. There is a slight drop in UK IT spend in 2017 and 2018, but demand recovers in 2019 and 2020, and the UK IT market returns to its pre-Brexit levels during 2020. Overall we would expect the IT forecast to be revised downwards by more than 2% through to 2020 on a compound annual growth rate basis. Western European IT spend is expected to remain fairly stable. IDC believes that this is the most likely scenario.

#2 Disruptive transition with 20% probability

This is the most pessimistic scenario and assumes contagion in terms of multiple referenda and immense pressure on the European Union model which creates further economic uncertainty. IT spend in this scenario would be expected to decline significantly in the short term and would struggle to rebound in the forecast period, with the strongest impact in the UK but also at the Western European level, with European Union that would be under greater pressure.

Overall we would expect the UK IT forecast to be revised downwards by close to 5% through to 2020 on a CAGR basis. Brexit will have more far reaching consequences, including headquarter, workforce, and factory relocations impacting IT spending.

#3 Swift transition with 10% probability

This assumes strong leadership steps into the existing vacuum and an orderly Brexit process occurring that avoids short-term turmoil and drives economic growth for the UK in the medium term. IT spend is affected mildly in the UK in 2016, but rebounds quickly in 2017 and beyond. Europe IT spend unaffected.

“Looking at major initiatives currently being put on hold such as the LSE-Deutsche Börse merger or Siemens freezing its new UK wind power investment, there is clearly a lot of uncertainty in the market, and in the disruptive scenario, we do see significant potential downside risks for UK and European IT spend if contagion in terms of copycat referenda in other parts of the European Union become more realistic,” said Douglas Hayward, co-lead for European Cloud research and AVP for European Services.

“As we mentioned in our previous assessment on the potential Brexit, we expect IT spend in financial services, manufacturing, and retail to be the most negatively affected by a Brexit decision, together with the public sector, which will face further cuts and austerity measures,” said Andrea Siviero, Senior Research Analyst for IDC European Industry Solutions. “Restructuring the financial single market on one side and the impact on the UK current account on the other could potentially lead these industry sectors to struggle as a result of Brexit.”