Shoppers can now use MasterPass, the digital commerce platform from MasterCard, to safely and seamlessly pay for in-store or face-to-face purchases at over 2,000 iKhokha retailers and service providers in South Africa using their smartphones or tablets.

This follows a collaboration announced by MasterCard and mobile commerce provider, iKhokha, which sees MasterPass’ digital checkout services integrated into iKhokha’s mobile payment application used by a wide range of small, medium and mobile enterprises including hair and beauty salons, tourism businesses, health care practitioners, and professionals like lawyers.

Since its launch in South Africa in July 2014, MasterPass has grown its acceptance network, with consumers able to pay using the digital wallet at more than 370 South African merchants including Takealot.com, Flysaa.com, Le Creuset, Flymango.com and Netflorist as well as over 250,000 merchants internationally.

When shoppers choose to pay iKhokha retailers using MasterPass, they simply open the MasterPass app on their mobile device, and scan the unique QR code that is generated on the iKhokha retailer’s smart device. After shoppers enter their bank PIN number or 3DSecure code and CVV/CVC number on their own device, the transaction is complete.

Unlike other similar solutions, each MasterPass transaction is classified as an Authenticated Mobile Transaction by South African banks, ensuring that consumers enjoy the highest protection from fraudsters. Anyone can use the Standard Bank and Nedbank MasterPass apps – even non-Standard Bank and non-Nedbank cardholders. MasterPass also accepts selected PIN-based debit cards such as Maestro, enabling millions of South Africans to make omni-channel payments.

For merchants, MasterPass provides a secure, quick and easy way to checkout their customers, which can lead to increased spending and more frequent purchases. It also opens new business opportunities and enables merchants to potentially increase their sales to consumers in 28 other countries where MasterPass is available including Australia, Canada, China, United Kingdom and the United States.

One such retailer is Ruth Mafupa, owner of Natural Moisture, a natural hair and beauty enterprise that manufactures products and then sells them wholesale to salons and directly to consumers online and from her store in Johannesburg. She accepts card payments on an iKhokha mobile point of sale device connected to her smart phone, as well as online and now in-store digital MasterPass payments using the iKhokha app.

Small business owners like Ruth Mafupa, owner of Natural Moisture in Johanneburg, can now accept card payments on the iKhokha device connected to their smartphones, as well as online and in-store digital MasterPass payments. The MasterPass app and iKhokha merchant app are both available from the iTunes and Google Play stores.

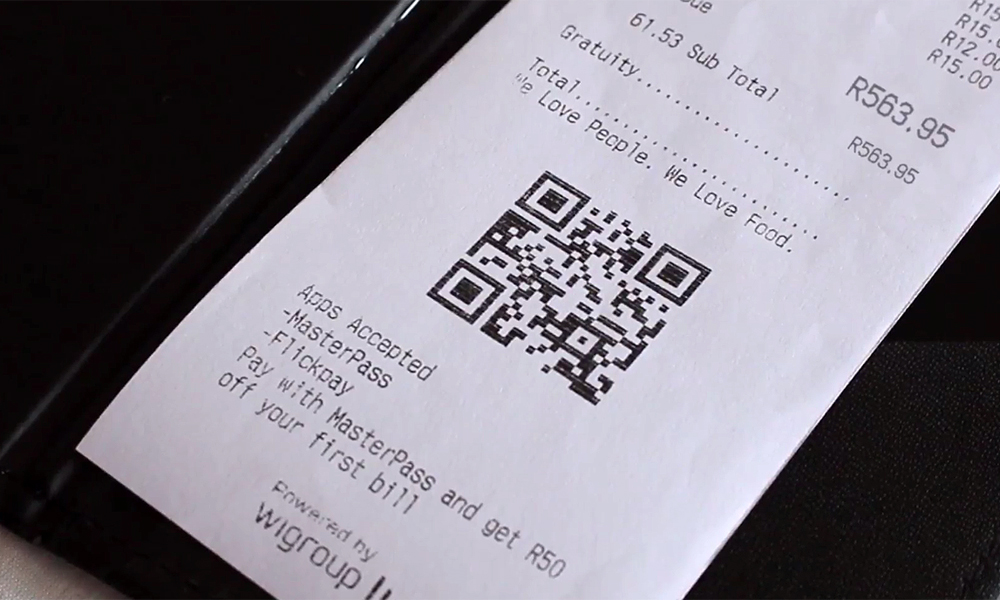

How to pay at iKhokha retailer using MasterPass

#1

Consumers need to download the MasterPass app from their service provider’s app store and register their details along with a nominated payment card debit, credit or cheque card from any South African bank.

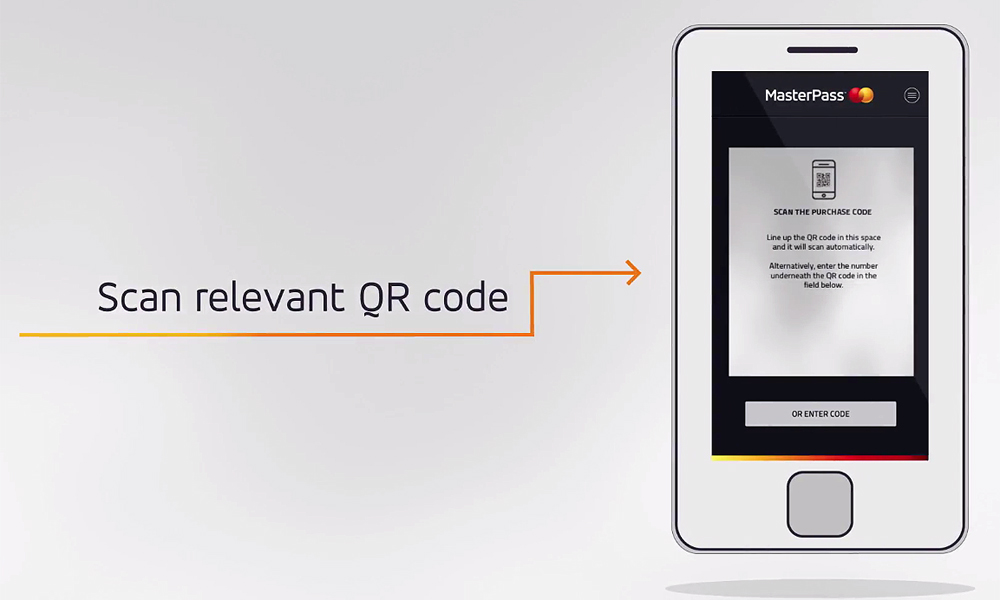

#2

When paying an iKhokha retailer using MasterPass, the retailer’s iKhokha app generates a QR code that displays on the retailer’s device screen.

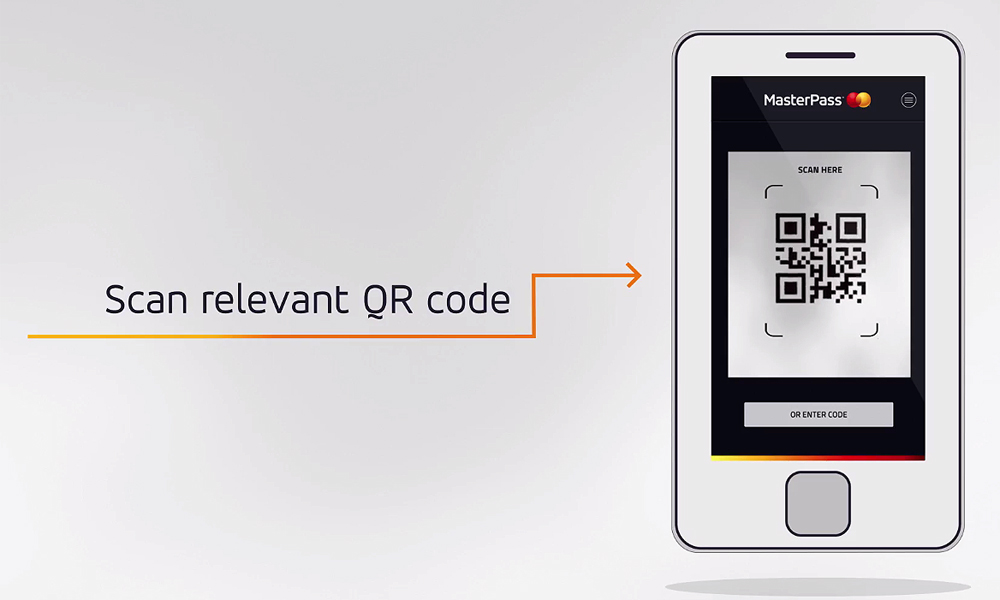

#3

Consumers open the MasterPass app on their own mobile device and scan the QR code.

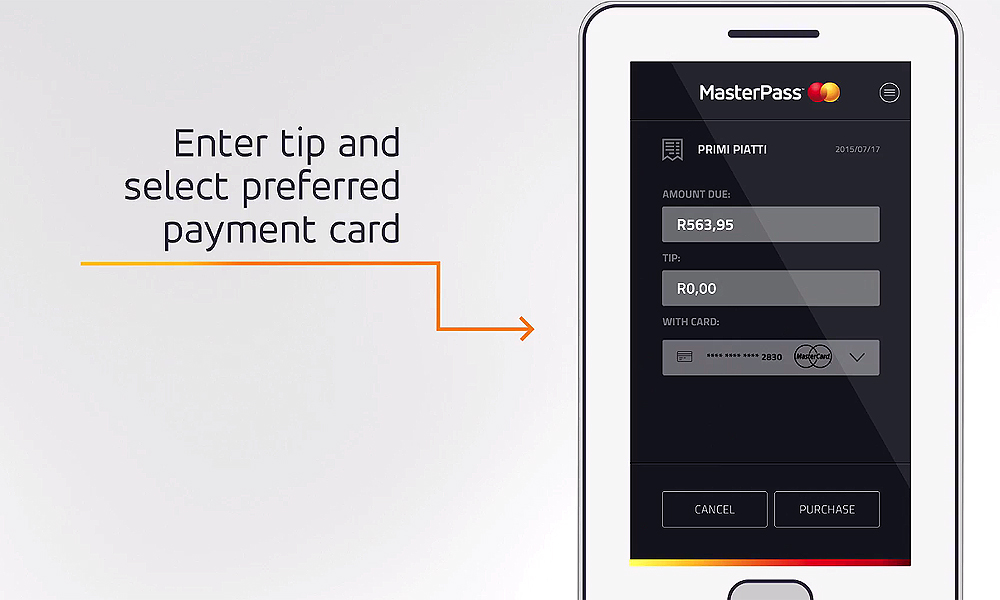

#4

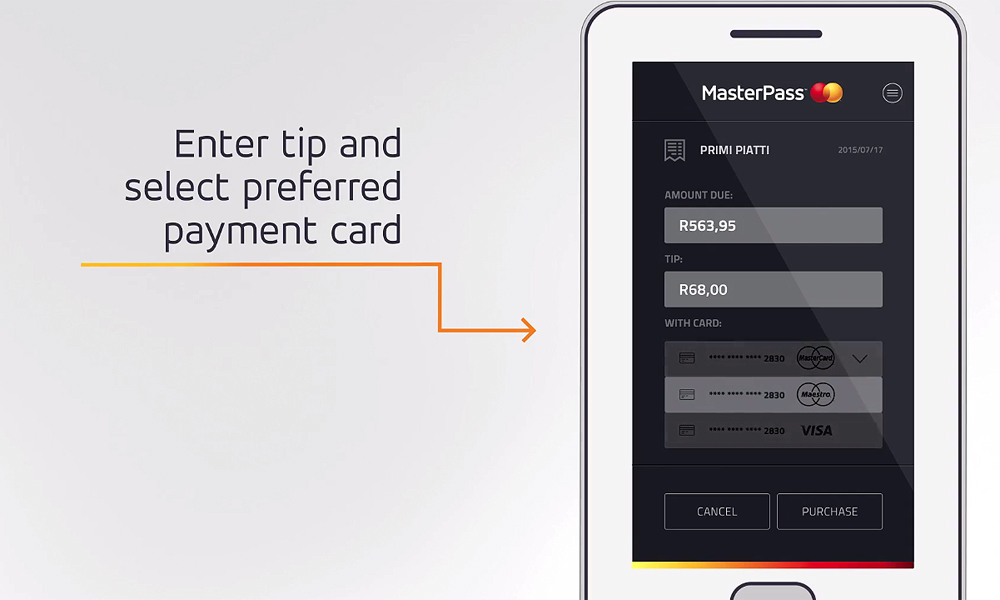

Consumers choose the preferred, pre-loaded debit, credit or cheque card they want to use for payment.

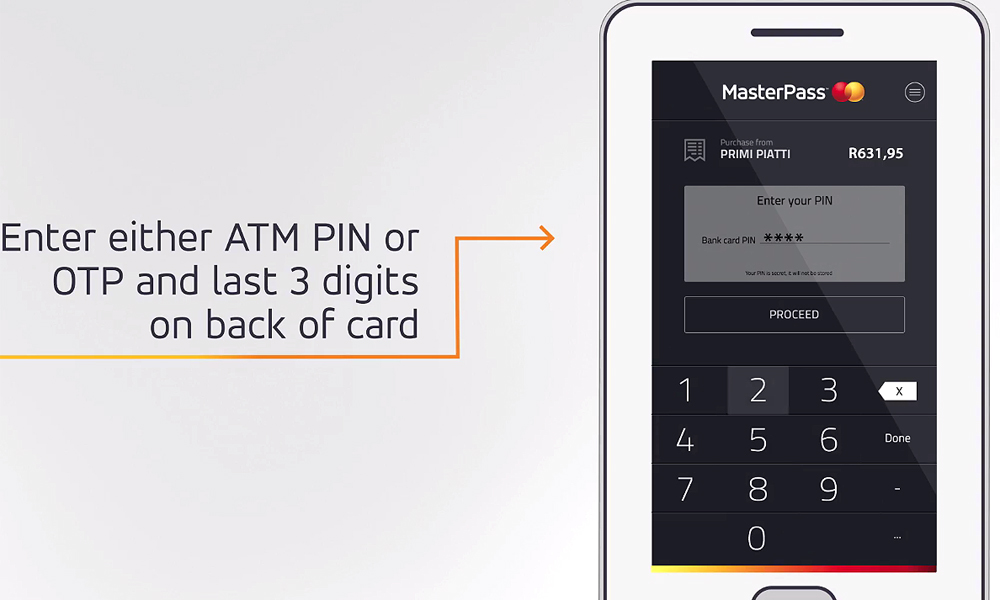

#5

Depending on the consumer’s bank, they will enter their bank card PIN or 3DSecure code and security CVC or CVV code, when prompted to authorise payment.

#6

When the transaction is successfully processed, the consumer and the merchant receive payment confirmation.

iKhokha is a local Durban based Fintech player and is helping transform small businesses in South Africa through mobile innovation. iKhokha currently supplies over 2,000 small and medium enterprises nationwide with an innovative, low-cost mobile payments solution, helping these merchants accept payment cards via a user-friendly, low cost chip and PIN card reader linked to a secure application on their connected mobile devices such as a smartphone or tablet.

The iKhokha app, which is compatible with Android and iPhone operating systems, enables users to complete a number of activities such as capture cash, process card and mobile payments as well as sell airtime for a rebate. MasterPass acceptance is now integrated into the iKhokha mobile application.