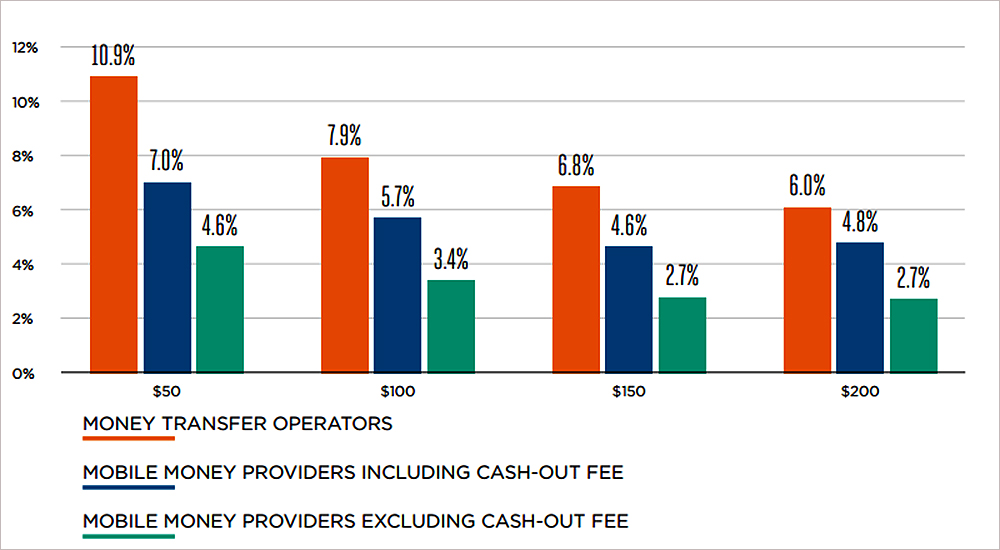

The GSMA issued a report entitled, Driving a Price Revolution: Mobile Money in International Remittances, that looks at the impact of mobile money on reducing the cost of international remittances. The findings show that the cost of sending international remittances with mobile money is, on average, more than 50% less expensive than using global money transfer operators. Additionally, where people were able to send remittances from a mobile money account, the average cost of sending $200 was 2.7%, compared to 6% when using global money transfer operators.

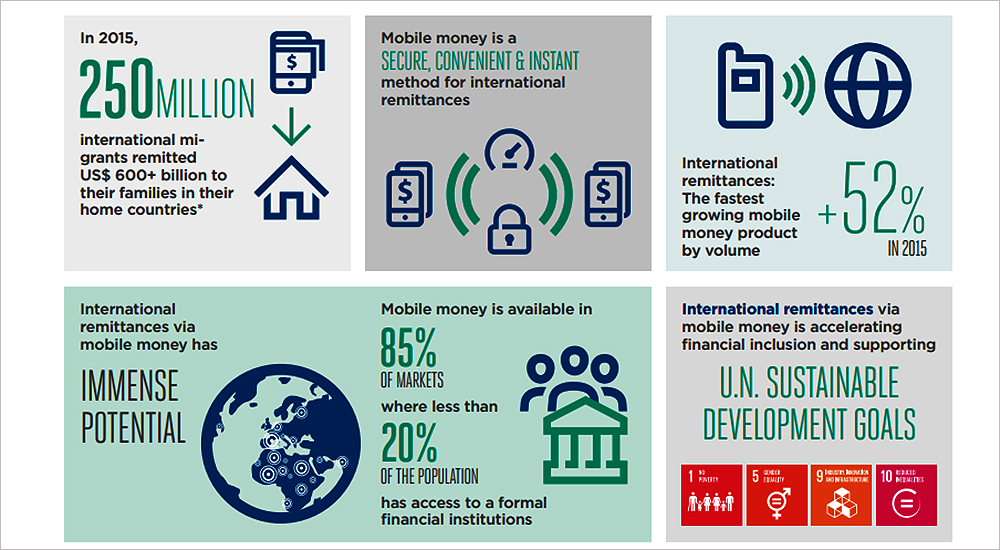

The research shows that by increasing competition, leveraging existing networks and infrastructure, and capturing smaller remittance values than traditional players, mobile money providers are strategically well-placed to lower international remittance costs. These lower prices, in turn, contribute directly toward achieving targets within United Nations Sustainable Development Goal, which sets clear objectives for reducing migrant remittance costs.

“Mobile money is one of the most exciting innovations in financial services, with more than 400 million registered consumer accounts across over 90 countries,” said John Giusti, Chief Regulatory Officer, GSMA.

“While today mobile money services are largely used for domestic transactions, international transfers represent the fastest-growing segment of mobile money services. In just a few years’ time, mobile money has moved from a purely domestic service to one that allows migrants to send remittances between more than 20 countries globally.”

According to the World Bank, more than 250 million people live outside their country of birth and regularly send money home, providing a financial lifeline to their families and contributing to the economies of their home countries. In 2015, global remittances totaled $581.6 billion, of which $431.6 billion, or nearly 75%, was sent to the developing world.

International remittances play a critical role in the economies of developing countries. However, the cost of international transfers remains high and directly impacts the income of remittance recipients. High fees for remittance transactions also encourage senders to use informal remittance channels, increasing anonymous cash-based transactions and creating new risks for financial integrity.

Giusti continued, “Through mobile money services, the industry is directly supporting the goal of expanded financial inclusion for migrants and their families by reducing international remittance costs. The potential gains of achieving this target could be as high as $20 billion in additional income for remittance recipients.”

This research was conducted using the methodology employed by the World Bank’s Remittance Prices Worldwide database. It compared the price of sending international money transfers directly from a mobile money account to the price of conducting the same transaction with a global money transfer operator.

The GSMA represents the interests of mobile operators worldwide, uniting nearly 800 operators with almost 300 companies in the broader mobile ecosystem, including handset and device makers, software companies, equipment providers and internet companies, as well as organisations in adjacent industry sectors.

Excerpted from GSMA report, Driving a Price Revolution: Mobile Money in International Remittances

Africa is the most expensive region to send money to, with an average cost of 9.6%. This remittance super tax is even stronger for intra-African corridors, where remittance costs can exceed 20%. High fees for remittance transactions also encourage senders to use informal remittance channels, increasing anonymous cash-based transactions and creating new risks for financial integrity. As a result, reducing remittance fees has become an important international policy objective. UN Sustainable Development Goal calls for, by 2030, a price reduction of migrant remittance transactions to less than 3% and the elimination of corridors where transaction costs are more than 5%. The potential gains could be as high as $20 billion in resources flowing directly to households.

Available in 93 countries, mobile money drives financial inclusion by allowing millions of previously unbanked and underbanked people to access formal financial services. Mobile money services are available in 85% of countries where the number of people with an account at a financial institution is less than 20%. At the end of 2015, there were 411 million registered mobile money accounts and 3.2 million mobile money agents who could facilitate cash-in and cash-out services.

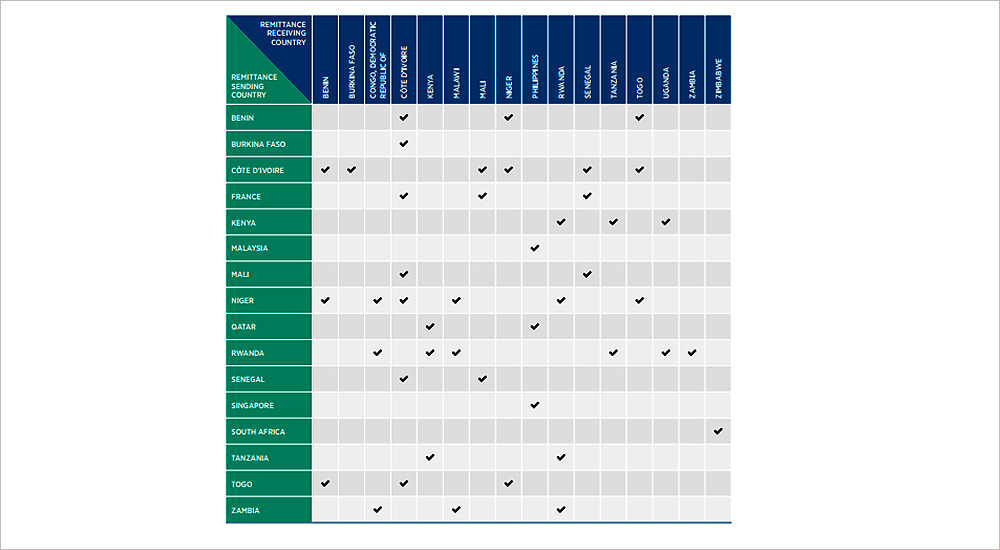

Mobile money is revolutionising the international remittance industry by leveraging broad mobile penetration and the asset-light business models of mobile operators. At the time of our research, 53 mobile money services, covering 170 million mobile money accounts, offered customers the ability to send money across 45 country corridors, a number which is growing quickly year-on-year. Interestingly, most of these corridors are between African markets where alternative formal remittance channels have a limited presence and can be particularly expensive. Mobile money is also gaining traction in a few North-South corridors targeting migrant workers who send money back home, for example between France and Côte d’Ivoire, Mali or Senegal using Orange Money.

In 2015, $5.2 billion was sent across these 45 corridors. While this represents just 1.2% of the $431.6 billion that was remitted to developing countries in 2015, the potential impact of mobile money on the remittance sector is much greater. Of all products available to mobile money customers, including P2P transfers, bill payments, merchant payments, bulk payments and airtime top-ups, international transfers were the fastest growing in terms of transaction volumes in 2015, YOY increase of 52% for the second year in a row, suggesting an important, untapped demand from customers.

For mobile operators, investments in international remittances are an opportunity to develop the digital financial ecosystem, which is critical to ensure the sustainability and profitability of mobile money. In that context, operators are entering into partnerships with different actors in the remittance value chain, including other mobile operators, to open corridors to and from markets in which they do not have a presence. Reflecting this, the 53 mobile money services covered by our study involve 10 different mobile operator groups, many of which are interconnecting with one another to join a sending channel with a receiving one.

For migrants and their families back home, using mobile money for remittances has a number of advantages, including increased convenience and security. Remittances are received directly on an individual’s mobile phone. The remittance can then be used to pay bills, make transfers, or simply store funds in a secured digital account, without having to travel to a remittance agent. On the sending side, the ability to initiate transfers from a mobile phone allows customers to check the total cost of sending, transaction fee plus the exchange rate, without needing to visit a remittance agent. This makes it easy for them to send money when the exchange rates are most favourable.

In August 2016, the GSMA commissioned an independent data collection exercise to assess the impact of mobile money on reducing the cost of remittances. The results show that mobile money is driving a price revolution in international remittances. It is doing this by increasing competition, leveraging existing networks and infrastructure, and capturing smaller remittance values than traditional players.

These lower prices are, in turn, contributing directly to efforts to achieve UN Sustainable Development Goal, which sets clear targets for the reduction of migrant remittance costs.

- Using mobile money is, on average, more than 50% cheaper than using global money transfer operators. In the 45 country corridors surveyed, the average cost of sending $200 using mobile money was 2.7%, compared to 6.0% using global money transfer operators. Lower transaction fees can translate directly into additional income for remittance recipients.

- Mobile money is particularly competitive for low value transactions. As such, it is well positioned to meet the need of low-income migrants who may find it more convenient to make low-value transactions on a frequent basis. In fact, the average value of international transfers sent using mobile money is relatively low $82 in June 2015, compared to the average size of international transfers across all channels, around $500.

- Mobile money is contributing to efforts to achieve UN SDG. The cost of sending $200 using mobile money is already less than 3% in 34 country corridors, and it is less than 2% in 15 country corridors.

- Mobile money is increasing competition, which is driving down the price of remittance services. Our research shows that global money transfer operators tend to offer their services at lower prices in markets where they are in competition with mobile money providers, 6.0% compared to 8.2%. This clearly illustrates the need to ensure enabling regulatory frameworks, which promote competition by allowing non-traditional players, such as mobile money providers, to offer international remittance services.

- Mobile money-enabled international remittances are contributing to broader financial inclusion and financial integrity objectives. Indeed, mobile money represents a powerful tool to digitise large flows of informal transfers. Mobile money can also act as a gateway to financial inclusion for both remittance senders and recipients, allowing them to join the digital financial ecosystem and to access a broad range of digital financial services beyond remittances, such as storing money in a secured account or performing digital payments.