At the World Economic Forum on Africa, IHS announced new analysis on bright spots for economic diversification in sub-Saharan Africa. “The commodity super cycle may have ended, but there are certainly bright spots for investors across Sub-Saharan Africa,” said Natznet Tesfay, Director of Sub-Saharan Africa analysis at IHS Economics and Country Risk.

Economic diversification and technology’s role as a growth engine are the focus areas for the 2016 World Economic Forum on Africa. “There is a lot of buzz at this year’s WEF around how countries can take advantage of new technologies to grow and diversify their economy,” Tesfay said. “Many African countries aim to transform through the development of manufacturing and service hubs, but have had mixed success in first building reliable critical infrastructure. Still, there are opportunities for investors across the region in growth industries such as power, including off-grid renewables, transport and logistics, ICT and light manufacturing, as countries look to secure long-term, resilient growth.”

President Kagame of Rwanda, whose country is hosting this year’s WEF on Africa, previously highlighted the importance in taking these first, critical steps for transformation in February. According to IHS analysis, Cote d’Ivoire, Tanzania, Kenya, Ethiopia and Rwanda are leading the pack with commitment to laying foundational infrastructure to underpin key growth industries. “Governments with a clear path for investment are already seeing the fruits of their labour,” Tesfay said. “We see growth of above 6% in these countries and we are forecasting growth rates above 4% forecast for Tanzania, Kenya and Uganda for the next 10 years.”

In a new report, IHS assesses that the telecommunications sector is likely to emerge as a leading source of capital expenditure for East Africa.

According to the report, Tanzania presents mobile network operators with a favourable operating environment due to competitive licensing agreements. In Uganda, the recent rollout of a regulatory framework for mobile and agency banking services provides new opportunities. The Kenyan government’s commitment to encourage growth in the telecoms sector is set to improve competition and inter-operability among existing mobile network operators and to stimulate mobile virtual network operator activity.

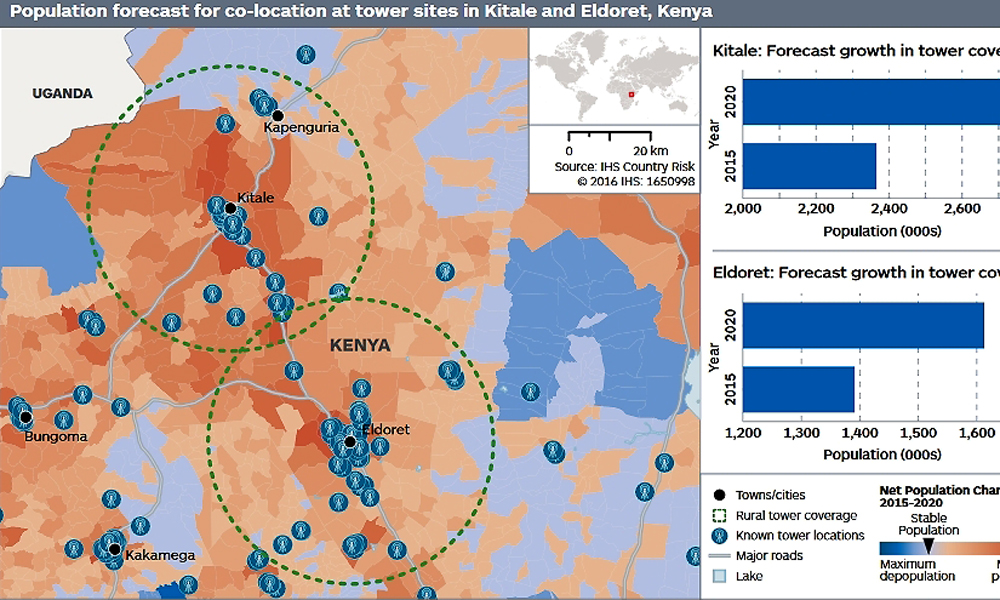

At the moment, Kenya’s telecoms infrastructure is largely concentrated in the southeast and west of the country. However, new infrastructure projects have the potential to drive more than half a million people to emerging areas of economic activity in Kenya’s north-west, particularly in Lake Turkana region with consumer spending on mobile handsets and calling plans expected to increase as a result. By forecasting population change and analysing population demographics, IHS identified three potential tower locations within the Rift Valley Province likely to benefit from the largest net increase in population.

“Our modelling capabilities are unique and show some optimistic results for an economic growth area in Kenya,” Tesfay said. “IHS analysis emphasises the point that there are growth opportunities across the region for companies looking to invest.”

The towns of Lokichar, Kitale, and Eldoret are likely to experience rapid population expansion over the next five years, roughly 35% 64,000 people, 11% 357,550 people and 12% 221,690 people respectively. Refurbishment and expansion of the Lokichar–Kitale–Eldoret highway into neighbouring South Sudan increases opportunities for wholesale and retail trade, while the UK owned Tullow Oil’s concession close to Lokichar slated to start oil production by 2020.

“These projects would create new centers of economic activity and employment opportunities,” Tesfay said. “This example highlights how companies might miss faster growth and attractive opportunities in medium-sized cities if they only focus on the traditional, major cities.”