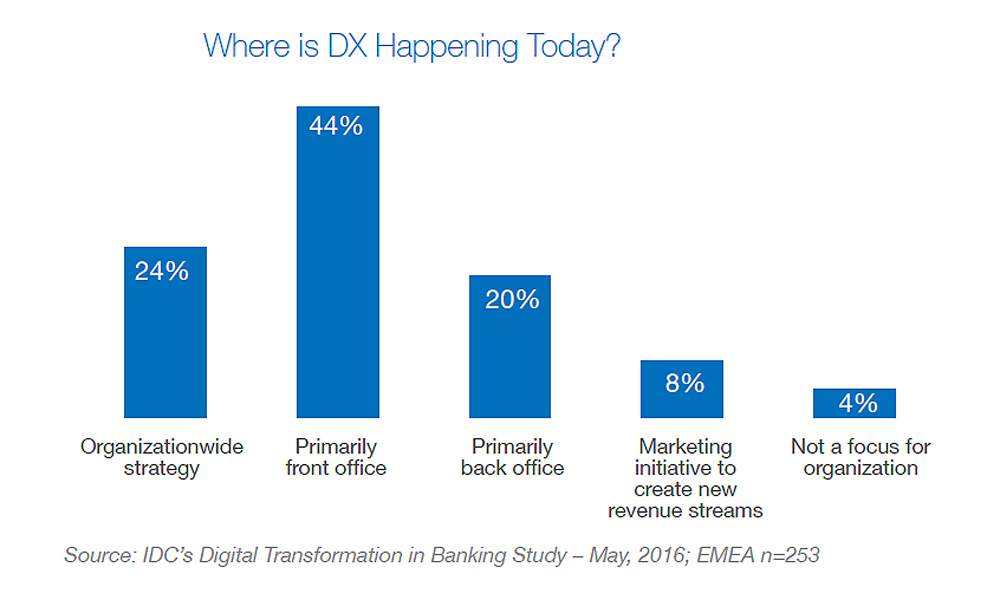

A survey released by SAP shows that just one in four banks, 24% in EMEA has created and executed a holistic end-to-end digital transformation strategy to engage customers. The study also showed that while 96% of the banks polled had completed some kind of digital transformation initiative DX, room for improvement remains.

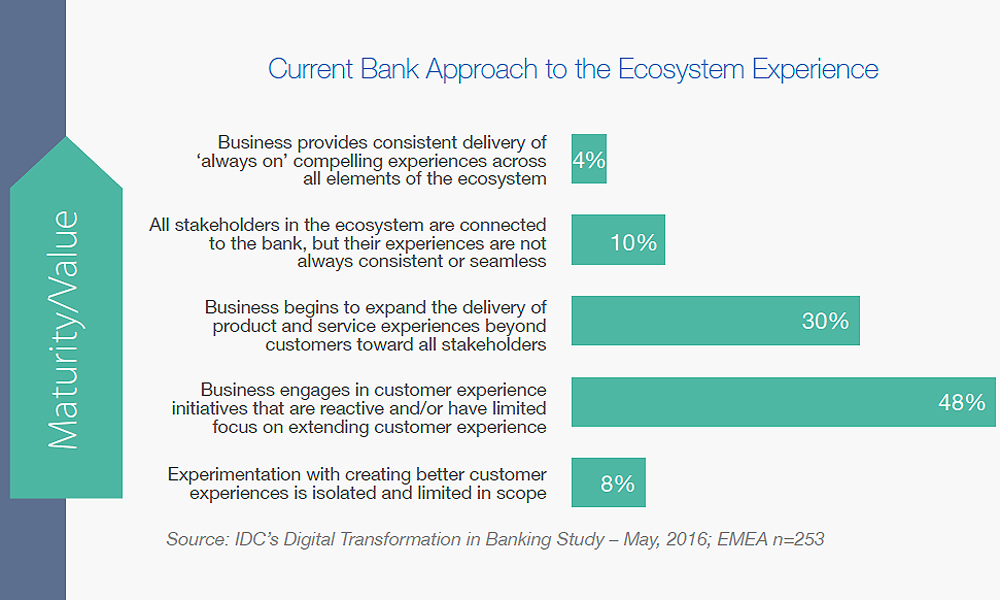

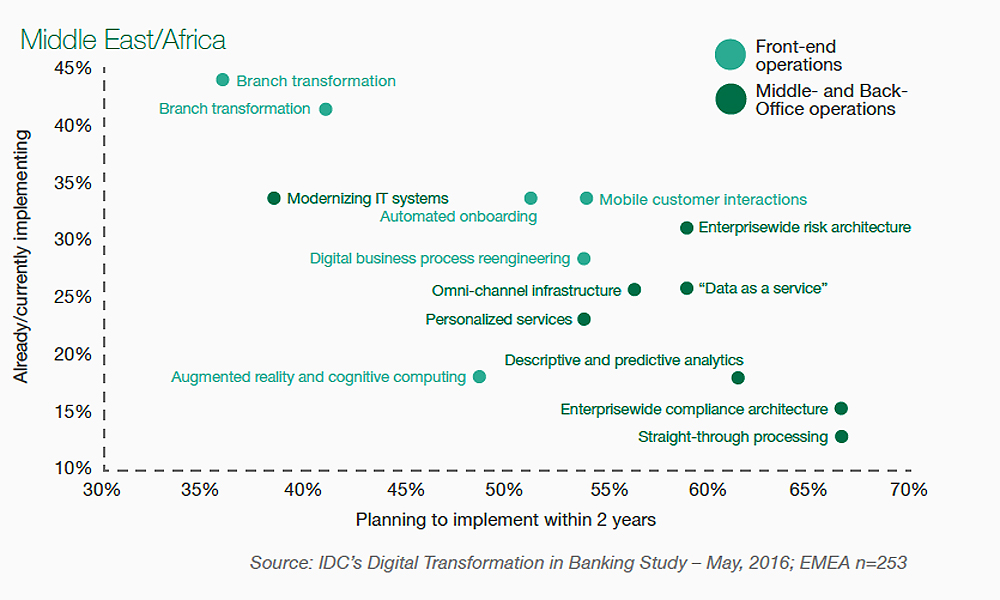

Conducted by IDC Financial Insights and sponsored by SAP, the study The Digital-Ready Bank, surveyed 250 retail and corporate banks across EMEA. The findings show digital transformation often occurs only in the front office, creating islands of innovation that prevent banks from reaping the benefits of digital transformation at an organisational level. Chief among these benefits is the ability for banks to reduce costs while still delivering an optimised and individualised experience to customers.

Other key findings of the study include:

- One in five banks 21%, surveyed currently have a Chief Digital Officer. IDC believes that one in two will have a CDO or digital leader driving enterprise wide digital transformation by 2020.

- The survey showed a positive correlation between the early involvement of IT and DX initiative success rates; 57% of projects where IT was brought in at the first stages of a DX initiative were deemed successful by the bank respondents.

- 40% of respondents indicate that digital transformation remains a front-office initiative aimed at improving customer experience.

- One in five banks said their digital transformation primarily included infrastructure work.

“There is no doubt that EMEA banks are creating added value for their customers through digital transformation projects, but I envision a brighter future,” said Laurence Leyden, General Manager for the Financial Services Business in EMEA, SAP. “By blurring the lines between front-office and back-office initiatives and creating a holistic approach to digital transformation, banks can evolve their services with their customers by becoming a lifelong partner.”

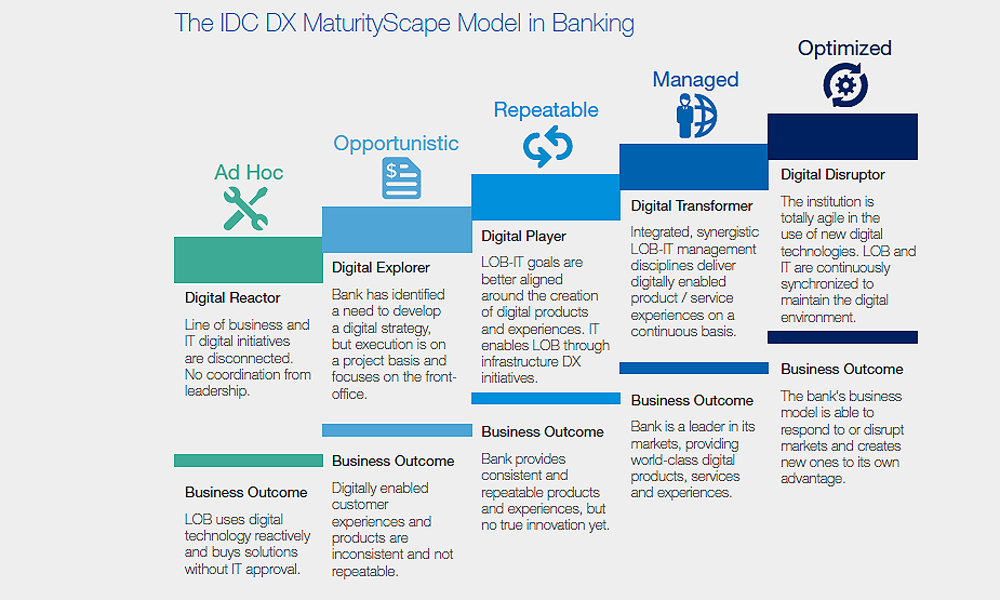

Jerry Silva, Research Director for IDC Financial Insights, said: “For digital transformation to become ingrained in a bank’s DNA and strategy, there needs to be a champion – and that is the Chief Digital Officer. The role of the CDO is still new and maturing, but it should be focused on aligning different segments of the organisation and different technology processes around one common goal – greater customer engagement and retention.”

The study found that key elements in creating enterprise-wide digital transformation included a collaborative culture and a focus on a digital core that embraced analytics and open, agile technologies. Another key element was a willingness to partner with external providers such as FinTech startups, technology providers and nonfinancial services firms that customers value.