A report from Salesforce highlights technological innovations manufacturers have embraced to prepare for the future of their industry.

Salesforce has published its first Trends in Manufacturing report, providing insight into some of the issues that global manufacturing leaders currently face and how they plan to adapt to a post-COVID era.

It also spotlights the technological innovations that certain manufacturers have embraced in order to feel prepared for the future of their industry.

“As manufacturers recover from the pandemic, it’s clear that there is a digital divide that has left some manufacturers prepared for the future of the industry and others struggling to meet evolving employee, partner and customer expectations,” said Cindy Bolt, SVP, Salesforce Industries.

“Manufacturers need to adopt the mindset of a technology company – moving operations to the cloud, leveraging automation and creating digital experiences for the customer – to help position their companies for success over the next decade.”

Cindy Bolt, SVP, Salesforce Industries

The report details six key findings on the future of manufacturing:

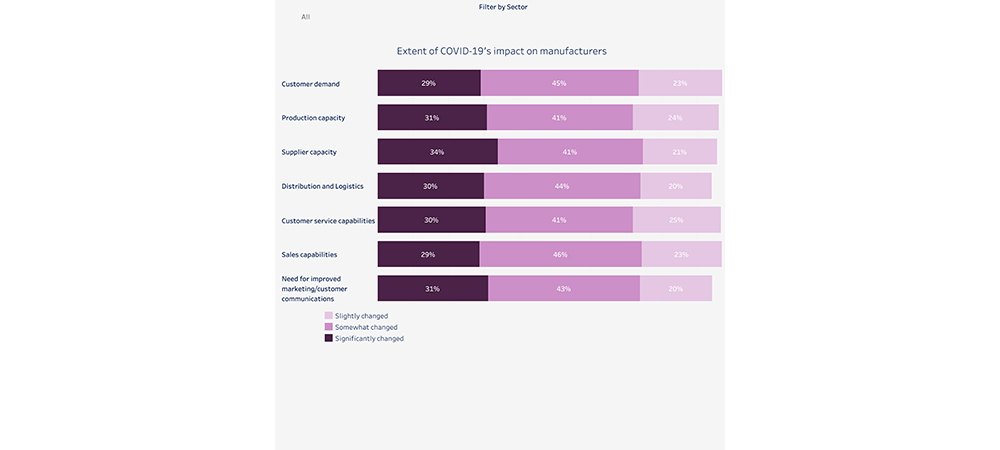

Manufacturers who were impacted by COVID-19 believe customer-facing changes to their business to be permanent

Manufacturers felt the impact of the pandemic across all lines of business. Many view these changes as permanent – with sales (57%) and customer service capabilities (56%) considered to be the most permanently altered by the surveyed manufacturers.

Lack of data transparency and siloed teams are significant barriers to accurate forecasting

One of the biggest foils to traditional forecast accuracy, according to the manufacturers surveyed, is a lack of data transparency and accessibility across the value chain:

- The majority of manufacturers responded that legacy tools (83%) and dispersed data (82%) are moderate or serious challenges, with close to a third (31%) of manufacturers viewing each as a serious challenge.

- More than eight in 10 manufacturers also consider siloed teams (sales and ops) and data being difficult to extract as challenges.

Manufacturing leaders cite Digital Transformation as a key priority over the next 24 months

When asked to list top priorities, manufacturers responded that increasing process efficiencies and improving demand planning (both 88%) were among the most urgent changes needed for a business, and they see Digital Transformation as a way to help. More than half (57%) of manufacturers say that moving their planning processes to the cloud is a critical or high priority.

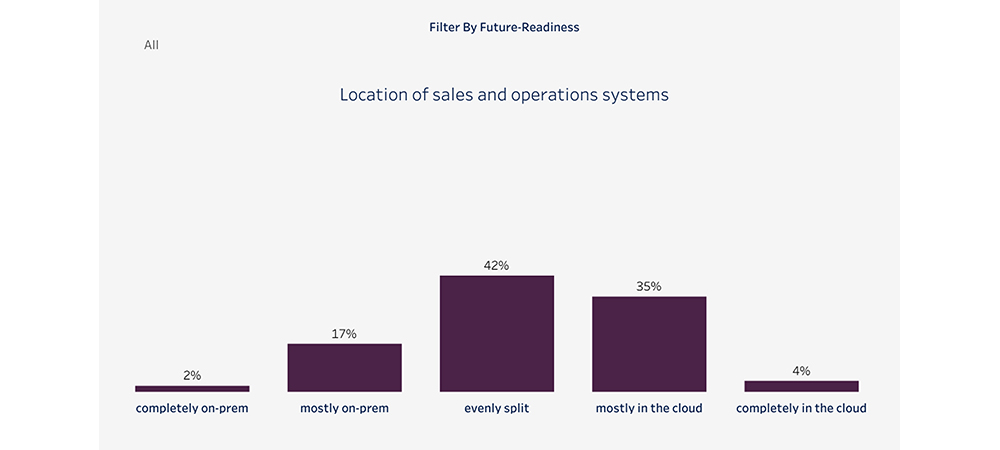

Manufacturers who feel ‘very prepared’ for the next decade are already mostly in the cloud

Nearly half (45%) of manufacturers who feel unprepared for the future have their sales and operation systems located either mostly or completely on-premises. The majority (77%) of manufacturers who felt future-ready had at least half of their sales and operation systems in the cloud.

Future-ready manufacturers cite rise in channel partner collaboration and mutual benefits as a value to their business

The report breaks manufacturers into two categories: future-ready and unprepared. Future-ready manufacturers are defined as those who feel their systems and technology are ready to handle the decade ahead, while unprepared manufacturers are defined as those who do not feel their systems can handle the next decade.

According to the report, future-ready manufacturers are nearly twice as likely to be satisfied with their channel partners than unprepared manufacturers (44% prepared manufacturers verses 25% unprepared manufacturers).

Future-ready manufacturers surveyed, when compared to unprepared manufacturers surveyed, are 23 percentage points more likely to feel that channel partners add value to their products and 26 percentage points more likely to feel that channel partners are driving enough marketing share.

Nearly one in three future-ready manufacturers are expanding ‘servitization’ services

As manufacturers look to diversify their revenue model, they are bundling product, support, software, and other services into a singular revenue model – also known as servitization.

The majority of prepared manufacturers (86%) say that servization is part of their company strategy, with 57% currently offering servization and 29% both offering and expanding these services. The majority of manufacturers (62%) who identified as unprepared do not currently have servitization as part of their strategy.

Methodology

Data in this report is from a double-blind survey conducted from August 29 through to September 15 2020 that generated 750 responses from manufacturing decision makers. Respondents are from across North America, Latin America, Asia-Pacific and Europe. All respondents are third-party panelists.