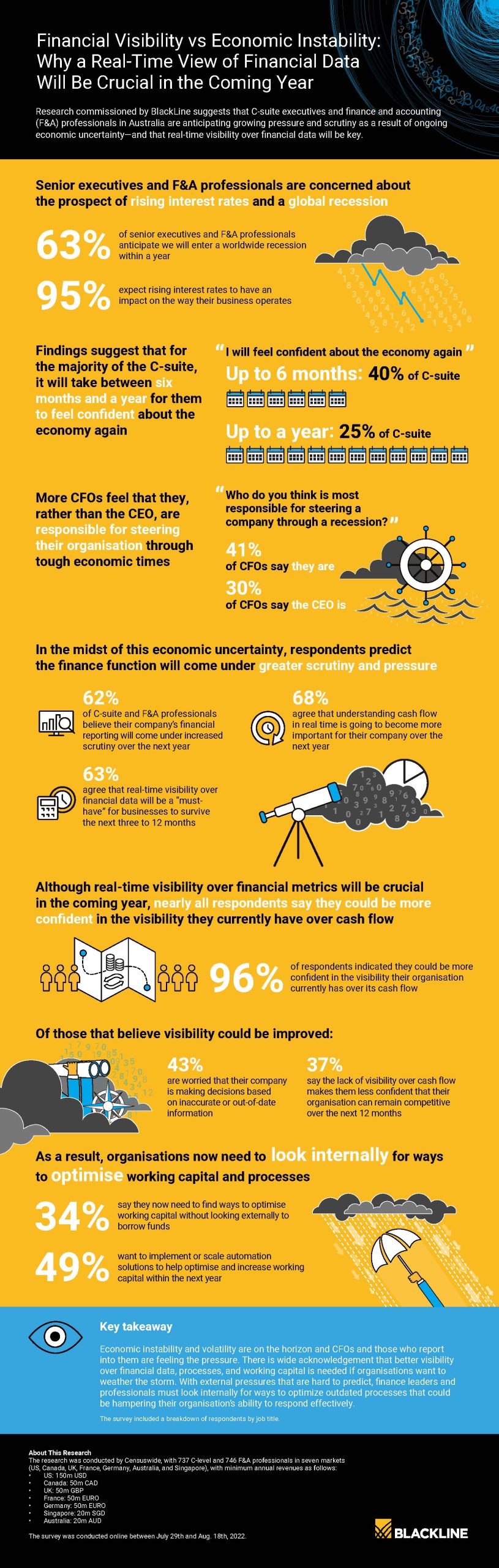

A global survey of C-suite executives and Finance and Accounting (F&A) professionals –commissioned by BlackLine – has revealed a significant lack of confidence among C-suite and F&A professionals when it comes to the visibility of cash flow. This suggests that many Australian organisations could be making decisions without an accurate, up-to-date view of company liquidity. This comes despite findings that suggest that visibility over cash flow and other financial metrics could be the key to businesses weathering the growing global economic storm.

The survey, which included 167 business leaders and F&A professionals (conducted by Censuswide) among 1,483 of their peers globally, also found that Australian businesses are anticipating growing pressure and scrutiny over company financials because of ongoing economic uncertainty. C-suite respondents indicated it will take between seven months and a year before they start to feel confident about the economy again. As a result, optimising working capital and processes is high on the agenda, as companies look to bolster their financial resiliency to combat market instability.

Keeping track of cash

With recessionary fears on the rise, 43% are concerned that rising interest rates will result in more of their customers paying late (rising to 47% among CEOs). Just over a third (35%) are worried that prospects or customers will have less income to spend, which could impact sales/revenue and 36% are worried that their organisation will face higher costs.

The majority agree (68%) that understanding cash flow in real-time is going to become more important for their company in the face of economic uncertainty. But nearly all respondents (96%) said they could be more confident in the visibility they currently have over cash flow.

This suggests that many businesses could be at a serious disadvantage when it comes to making strategic decisions. Of those that believe visibility could be improved, 43% are worried their company is making decisions based on inaccurate or out-of-date information and 37% say the lack of visibility over cash flow makes them less confident that their organisation can remain competitive over the next 12 months.

“Economic instability, the management of customer data and regulatory compliance in many industries have increased over the past few months, adding more uncertainty to an already challenging and uncertain global business environment,” said Claudia Pirko, Regional Vice President Account Management Organisation, BlackLine. “Finance and Accounting now finds itself caught in the eye of the storm feeling the pressure to once again step up to provide clear visibility into enterprise performance.

“There is widespread acknowledgement that better insight over financial data, processes and working capital is needed if Australian companies can weather the storm. Company management will need to carefully consider how their organisation can respond and remain competitive, resilient and emerge stronger in the year ahead from many years of recent disruption.”