Missed payments, errors and lost paperwork plague traditional invoicing. E-invoicing offers a secure and efficient solution, streamlining workflows and boosting tax compliance. It shouldn’t come as a surprise that e-invoices are slowly but surely becoming the norm in today’s business. The digital changes aren’t just affecting the way organisations issue and receive invoices, but also the technical side of transmitting data to other entities. With the introduction of new e-invoicing mandates and compliance requirements for B2G, B2B and B2C transactions, two predominant invoicing models have emerged; post-audit and clearance.

Global e-invoicing mandates

Electronic invoicing has a long list of benefits for the taxpayers. E-invoicing:

- Streamlines workflows, significantly reducing processing costs and errors

- Decreases paper use, fostering a greener and more sustainable work environment

- Enhances tax compliance through more accurate and timely records

- Promotes process automation, modernising various business processes within the company

But why do governments implement mandates to enforce e-invoicing?

The mandatory adoption of electronic invoice exchange is driven by both the need to close the tax gap and the desire to accelerate and simplify document flow.

The tax gap refers to the difference between the total amount of tax that should be collected by a government and the amount that is actually collected. It essentially represents the lost tax revenue due to various factors such as under-reporting of income.

Fighting the gap with e-invoicing is a much better solution than raising taxes and is just as effective.

E-invoices are controlled by each country’s tax administration, just like regular invoices. However, electronic invoices offer advantages due to streamlined, accurate reporting and a reliable audit trail, leading to a better assessment of the tax volumes, combating fraud and improving financial transparency.

When governments implement e-invoicing to address the tax gap, they can choose different models and formats (including required fields on invoices, reporting frequency, etc.). This leads to differences in invoice formats from country to country. These regulations, often technical and complex, require internationally operating companies to continuously adapt to stay compliant. The two most popular e-invoicing models are post-audit and clearance.

Post-audit e-invoicing model

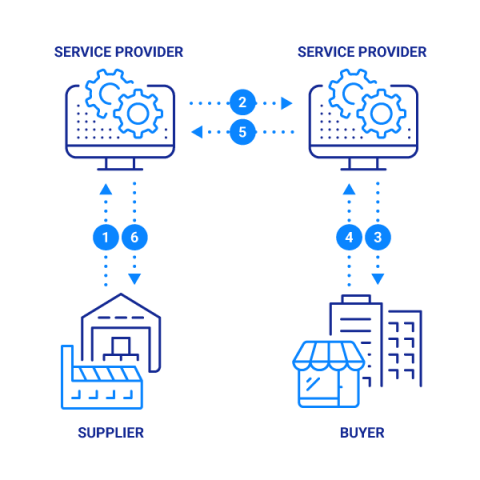

In the post-audit model, data is transmitted between partners without involving the authorities in the process. However, tax authorities can still audit these transactions for compliance later.

In regions where post-audit e-invoicing is mandatory, the authenticity and integrity of data must be ensured. This can be achieved through a combination of traditional post-audit practices and modern methods such as:

- Electronic data interchange (EDI) software

- Digital signatures

- Business controls

In post-audit models, achieving compliance is an ongoing process that involves adapting to local requirements. Reporting then takes place “after the fact”, ensuring data aligns with those requirements. Businesses have some flexibility in choosing their e-invoicing method, depending on the specific regulations in their country. However, they must ensure proper storage of invoices for potential audits, usually for up to 10 years. Audits from the tax administration can happen periodically after the reporting deadline or by request. In essence, companies are responsible for proving the authenticity (veracity in accounting terms) of their invoices.

Countries using the post-audit model

The post-audit model is currently used by most European countries, Canada, and Australia.

The United Kingdom exemplifies a post-audit model for e-invoicing in B2G and some B2B transactions. While e-invoicing isn’t mandatory for most businesses, the government encourages electronic transactions, particularly with the National Health Service (NHS) which requires a specific e-invoicing solution. Other public entities must be able to receive e-invoices if their suppliers choose to send them electronically. Adding to the flexibility, e-invoices can be structured (XML) or unstructured (PDF), with traditional EDI formats also accepted.

Clearance e-invoicing model

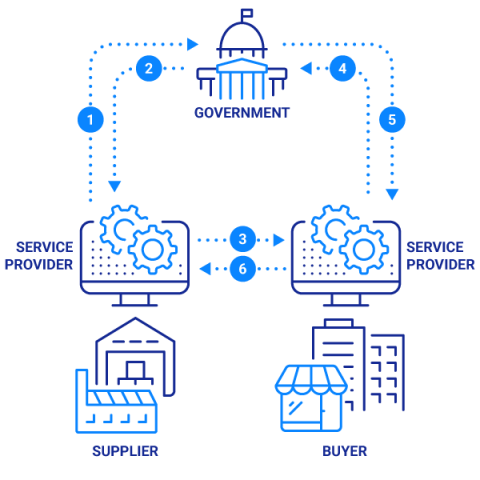

The clearance model proposes a different approach. Here, e-invoices are transmitted via government platforms that enable tax authorities to view transaction documents in real-time. Each invoice must be reported and authorized electronically before or during the exchange process. Additionally, each invoice has to be submitted in a specific format, such as structured XML format. The majority of the data is sent and analyzed in real-time or near-real time. Compared to the post-audit model, clearance approaches monitoring and transaction supervision more directly.

This way, the invoice can be approved before it gets sent to the recipient. After the validation, the government entity stamps, signs, or codes the confirmation, thereby authorizing it to be sent to the recipient.

Countries using the clearance model

Gaining traction globally, the clearance model in e-invoicing grants governments real-time control over business transactions. Unlike the post-audit model, invoices require pre-approval to ensure data accuracy, with variations in implementation across countries. This approach reflects the government’s right to inspect all transactions for effective tax enforcement.

Recognising the inefficiencies of fragmented systems across Europe, the European Parliament took steps towards a more harmonised approach to e-invoicing in 2022. This resolution called for a harmonised standard, exploring the possibility of mandatory e-invoicing with a focus on cost reduction for small businesses. Additionally, the potential for real-time reporting and state-controlled systems with data security was emphasised. In anticipation of the VAT in the Digital Age regulations, countries such as Poland are accelerating their e-invoicing implementation efforts. ViDA is expected to phase out clearance models, so Poland will likely need to adjust its current system to comply.

Following this trend, Poland has already established the SAF-T system and is transitioning to a clearance model through the country’s National Electronic Invoicing System (KSeF). KSeF utilises a mandatory XML format and is currently in a voluntary phase after a pilot period. While initial plans targeted a 2024 mandate, delays due to major errors in the platform and further considerations have pushed back the mandatory rollout. Poland is the latest EU Member State to adopt a clearance model for e-invoicing, transitioning from a post-audit approach. The implementation timeline is as follows:

- February 1, 2026: Applies to entities with sales value in the previous tax year exceeded PLN 200 million

- April 1, 2026: Applies to all other businesses

Other countries that are implementing the clearance model include Italy, Turkey, and several Latin American nations. Additionally, Hungary employs this model, featuring real-time invoice reporting.

Post audit vs. clearance: summary

| Post-Audit | Clearance | |

| Level of Tax Authority Involvement | Low The tax authority is not involved in the initial invoice exchange | High Invoices must be pre-approved by the tax authority before issuance |

| Invoice Approval Process | No upfront approval is required | Real-time or near-real-time validation |

| Data Accuracy and Security | Requires robust internal control to ensure data accuracy for audits | Higher potential for data accuracy due to real-time validation |

| Business Flexibility | More flexibility for businesses to choose their preferred e-invoicing method | Lower flexibility as businesses must adapt to specific e-invoicing formats and regulations |

| Adoption | Most European countries, Canada, and parts of Asia | Latin America, Italy, Poland, and Turkey |

The importance of understanding e-invoicing regulations

The two main approaches to e-invoicing mandates are the clearance and post-audit models. In the clearance model, the government takes a proactive approach, requiring pre-approval of invoices before they can be issued. This ensures real-time data validation and minimises the risk of errors or fraud. Countries such as Poland are adopting this model for tighter tax control. The post-audit model gives companies more flexibility in their invoicing methods. However, the responsibility falls on businesses to ensure proper storage of invoices for potential audits which can be a burden for some organisations. Additionally, the weight of ensuring data accuracy ultimately rests with the company.

Understanding the specific e-invoicing regulations in each country you operate in is crucial. Non-compliance can lead to hefty penalties, delays in receiving payments, and reputational damage. This complexity is especially magnified for companies conducting business across borders. Varying tax laws and e-invoicing mandates can make international invoice transmission a challenge. However, the right e-invoicing software can help navigate these complexities. It can ensure compliance with different regulations, automate invoice formatting and transmission, and simplify communication with tax authorities.

Regardless of whether your business operates domestically or internationally, a robust e-invoicing system is essential to ensure smooth operations and avoid unnecessary headaches. The cloud-based Comarch e-Invoicing platform cuts through the confusion. Our software ensures compliance with regulations in over 60 countries, regardless of the specific model. Streamline your global invoicing, automate processes, and stay ahead of changing regulations with Comarch.