Bank ABC, the Bahrain-based bank which serves customers on five continents, covering countries in the Middle East, North Africa, Europe, the Americas and Asia, has become the first Middle East bank to leverage face-based biometrics and Machine Learning to streamline the Know Your Customer (KYC) and identity-proofing processes. Utilising Jumio’s AI expertise it is streamlining the digital onboarding process, achieving the aim of eliminating the need for customers to visit branch offices when creating new banking accounts and creating seamless and quicker customer journeys for accessing banking services securely.

Jumio, a leading AI-powered trusted identity-as-a-service provider that has verified over 200 million digital identities, is transforming the banking sector with its work with Bank ABC, one of the MENA region’s leading international banks.

Jumio’s solution is enabling Bank ABC’s new mobile-only bank to compliantly on-board new individual customers using Jumio’s biometric-based identity verification solution.

Based in Bahrain, Bank ABC provides retail banking services through its network of retail banks in Jordan, Egypt, Tunisia and Algeria.

It has invested in establishing digitised operations including a fully digital KYC capability. Simplifying and streamlining the on-boarding process is central to these efforts.

Traditionally, it takes consumers one to two weeks to create a new account and requires them to visit a local branch in person to complete the account set-up process.

“Bank ABC is committed to leveraging the benefits of AI technologies to create seamless customer journeys for accessing banking services securely,” said Sael Al Waary, Bank ABC’s Deputy Group Chief Executive Officer.

Earlier this year at the third Middle East and Africa FinTech Forum, Al Waary said: “Across the region, banks and other financial institutions are facing enormous disruption from technology. But change should be embraced, not feared. Technology will revolutionise the way we do business. More importantly, it will empower people across the region, and be a force for true inclusion.”

Yousif Almas, Group Chief Innovation Officer at Bank ABC

Yousif Almas, Group Chief Innovation Officer at Bank ABC, said: “We’re proud to be the first bank in the Middle East to leverage face-based to streamline the KYC and identity-proofing processes.

“As more and more customers move online and transact via their mobile devices, it’s critical for Bank ABC to deliver a simple, fast and intuitive onboarding experience that takes minutes, not hours or days.”

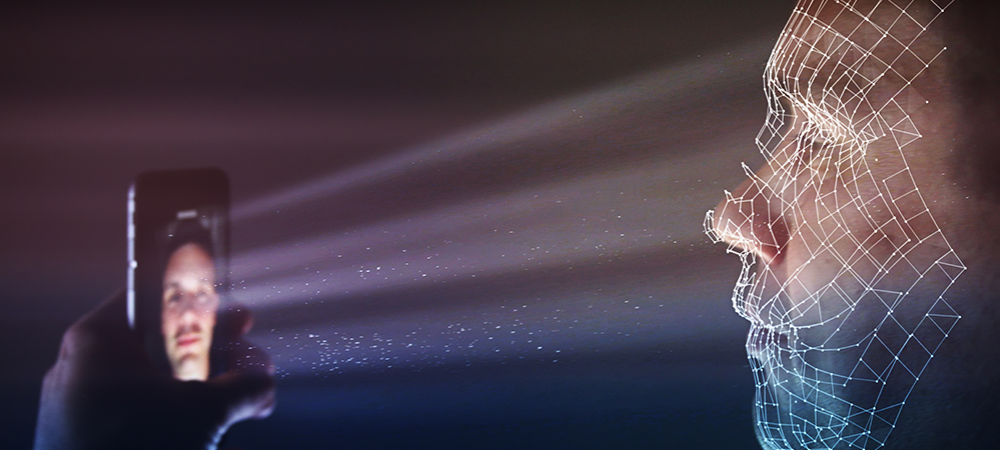

Bank ABC’s integration of Jumio’s Identity Verification enables the bank to verify online customers by having them first capture a picture of their government-issued ID with a smartphone and then take a selfie, with certified liveness detection functionality.

This process ensures that the user is who they claim to be and physically present during the transaction. As Bank ABC expands digital operations globally and in the MENA region, Jumio will support such growth with its ability to verify IDs digitally across geographies.

“Jumio is excited to partner with Bank ABC and help the company revolutionise digital banking in the Middle East,” said Robert Prigge, Jumio President. “We’re happy to contribute to their mission of delivering a level of service that matches, or exceeds, the market practice internationally by providing the leading-edge identity verification services that vet the digital identities of new customers – quickly, securely and compliantly.”

Intelligent CIO spoke to Yousif Almas, Group Chief Innovation Officer, Bank ABC, and Robert Prigge, President, Jumio, about the benefits of the solution.

What is the benefit of eliminating the need for customers to visit branch offices to set up new banking accounts?

Yousif Almas: Typically, it takes a visit to a branch to open an account, or recently with some banks, a video call. At Bank ABC, when it comes to implementing technologies, we are of the firm belief that we have to think from the user’s perspective and understand what they need first. This traditional process simply doesn’t fit in with the lives of our vision on how to serve our customers, whereby ease and simplicity are key.

Therefore, by deploying Jumio’s technology, we can dramatically speed up the process and put our customers in control, and with a high mobile penetration in the Middle East, the process of taking a selfie is something that consumers are already familiar with. Importantly, it takes just seconds, which is a vast improvement on the time that it takes to visit a branch and open an account.

How has the bank been able to leverage face-based biometrics to streamline the KYC and identity-proofing processes?

Yousif Almas: Jumio has provided us with a reliable technology that aligns with our digital-only strategy, allowing us to become the first bank in the Middle East to leverage face-based biometrics and Machine Learning to streamline the KYC and identity-proofing processes.

Our integration of Jumio’s Identity Verification enables us to verify online customers by having them first capture a picture of their government-issued ID with a smartphone, then take a selfie with certified liveness detection functionality. This means we can ensure that the user is who they claim to be and physically present during the process.

What’s more, Jumio’s technology helps to reduce fraud and we’re working with the team to ensure that we’re compliant with all of the various regulations in the region as we scale across geographies.

Can you explain what certified ‘liveness detection functionality’ is and what the benefits of it are?

Robert Prigge: As biometric-based verification has grown in popularity, the incentives for fraudsters to penetrate the systems have grown as well. These cybercriminals try to spoof a system by using lifelike artefacts including photos, video playback, masks and voice recording as a means of tricking the biometric systems into creating new online accounts by falsely accepting an artefact in lieu of a real person.

Jumio has pioneered real-time, biometric-based liveness detection to better thwart these growing spoofing attempts. Our certified liveness detection functionality ensures that the individual behind an online verification is physically present during the account setup process or when they log into their online account.

The process starts by having the user capturing a picture of their government-issued ID (e.g., driver’s license, passport or ID card) – front and back – and then having the user take a selfie with their smartphone or webcam. It’s during the selfie-taking process that Jumio checks for liveness. Jumio analyses the pictures of the ID document to ensure that it’s authentic and unaltered. If the ID is authentic, then Jumio compares the picture on the ID to the selfie. Based on these checks, Jumio delivers a definitive yes/no decision to the business so they can then more confidently onboard and authenticate users.

While this process is simple and intuitive for legitimate users, Jumio’s liveness detection functionality has a chilling effect on fraudsters, since most of them prefer not to have their likeness captured by the company they’re attempting to defraud.

What necessitated your decision to implement the solutions?

Yousif Almas: Our aim is to have the best first-time account opening process in the region. Jumio’s technology is already trusted and deployed by many traditional and challenger banks, globally, such experience that Jumio had was one of the factors that made us decide to partner with them.

Importantly, we recognise that opening an account is always the user’s first experience of dealing with a bank, so it is therefore very important that we do it right. By using Jumio’s technology for our upcoming mobile-only bank, we can ensure that a customer’s first interaction is seamless and easy. We will then look to implement this technology into other business lines in different geographies to extend this hassle-free first-time account opening process.

How do your customers benefit from the new system?

Yousif Almas: Customer experience is an overused term and means many different things to many different people. To us, though, it’s about how we enable our customers to live their lives and carry out money matters with minimal effort. Opening an account allows people access to make or receive payments, start saving or investing, and much more – by making this an effortless process, we are supporting people to build good money management habits.

What’s more, we’re committed to improving financial inclusion in the Middle East and creating an easier account opening process is fundamental to this. We’ll be looking to deploy Jumio’s technology in regions where access to branches is difficult, therefore, helping to improve access to financial services.

How do Jumio’s end-to-end identity verification solutions help fight fraud and how secure are they?

Robert Prigge: Cybercriminals are becoming increasingly savvy and mitigating fraud risk is essential to the success of any business. Unfortunately, traditional methods of online identity verification aren’t cutting it anymore and are vulnerable to a multitude of attacks, including social engineering, man-in-the-middle, phishing and Dark Web-based exploits. Jumio’s mission is to protect the ecosystems of our customers by identifying the fraudulent customers and ensuring that the good customers have a positive online experience.

Jumio’s end-to-end online identity verification solutions quickly and accurately verify the authenticity of an ID, document or real-world identity in seconds – not hours or days. We use a unique hybrid approach of Artificial Intelligence, biometric facial recognition, Machine Learning, liveness detection and computer vision technologies to thwart online fraud and account takeover.

We’ve verified over 200 million digital identities, which equips us with a significant competitive advantage in training our AI algorithms to more accurately identify and detect fraud patterns. We also leverage human verification experts who can detect any fraud missed by the AI algorithms as well as better train our algorithms on a daily basis.

With this approach, Jumio gives its customers a definitive yes or no decision about whether to accept or reject an online verification transaction with the highest accuracy rates in the industry. And this definitive decision dramatically reduces the manual review and customer abandonment costs for our business customers.