We hear a lot these days about the value of data. It’s not uncommon to hear it compared to another asset that has brought wealth to the Middle East. Piyush Kumar Chowhan, Group Chief Information Officer at LuLu Group International, tells Intelligent CIO precisely how organisations can create real customer value through the use of its data.

Piyush Kumar Chowhan is one of the speakers at Smart Data Summit in Dubai . The event has been postponed until October 26 and 27 and will take place at the Convention Centre, Sofitel The Palm Resort & Spa, in Dubai. You can view the event’s website here.

How can customer value be created through the use of data?

We are living in a digital era where customers are demanding a unique and personalised experience based on their preferences. Organisations are struggling to cope with this new reality of the digital savvy customer.

The traditional methods of creating focus on internal operations which are structured with multiple silos is one of the biggest bottlenecks in creating a customer centric culture in the organisations.

Organisations need to break their silos and adopt a data first approach which will help make them understand customer behaviour to serve them better.

It was in 2010 that Roger L. Martin published an article titled The New Era of Customer Capitalism which emphasised how companies need to be customer driven rather than shareholder focused to be successful in the 21st Century.

Forrester, a leading research firm, published a report in 2018 showing how companies who focus on customer experience delivered 30% higher stock returns as compared to those who were laggards in customer experience.

Hence, organisations need to re-invent their focus on the customer and re-invent the experience. The advent of new technologies alongside the use of data will help them achieve this new differentiated Customer Experience (CX).

How can organisations drive themselves towards data enabled decision making?

While the cliché ‘Data is the new oil’ has been talked about since the last decade, organisations are still in their infancy to transition towards this new paradigm.

Organisations have to embark towards this Digital Transformation journey where data enabled decision making becomes the major capability to transform the way customer experience is defined. This transformation needs to be driven by the board and customer experience has to be kept in the centre of this transformation.

Can you give us an example of a major bottleneck in creating a truly customer centric data view?

Yes. Most organisations believe that they already use data for decision making which may not be totally true. The organisations of the past have been built around functions and processes and everyone has their own view of the data. Sales looks at category-wise sales data while the supply chain looks at channel-wide supply data. Marketing looks at ATL/BTL spends across the marketing channel, while HR looks at employee and internal data.

This inward-looking view of data in silos is the biggest bottleneck in creating a customer centric data view. This leads to viewing data from the functional view rather than view of the customer.

What is the remedy for such a bottleneck?

Organisations have to take a fresh look at their data repositories and build a large data lake with customers view being at the centre. This transition is difficult and a lot of organisations are trying to re-hash their current data warehouses which are built on old architecture giving limited benefits. This is where cloud-native data repositories will play a big role in creating this competitive advantage. This transition is a journey which is going to be a basic fundamental pillar for any Digital transformation strategy.

Can you give us another example of a major bottleneck in creating a truly customer centric data view?

Yes. Those organisations that think: ‘We get data every day from our systems’. Traditional systems and data warehouses were built for batch processing which makes data stale for use in this fast-paced customer centric world. Information about items which were out of stock if available the next day from ERP systems have little relevance since a retailer would have already lost sales.

Can you suggest a remedy for this?

Invest in a modern cloud-native data platform which uses microservices for processing and federation of data. This needs to keep the customer experience in the centre. The modern data platforms need to bring in this real-time actionable insight in the hands of business users.

Can the fact that some organisations think they don’t have enough data create a barrier to creating a truly customer centric data view?

Some organisations think ‘We don’t have enough data’. There are functions in organisations which complain about availability of data, which sometimes may not be completely true. The new age worker requires a basic working capability to pull and use data from various sources. The use of internal structured data to be married with external unstructured data is a basic capability to excel in this digital workspace. The technology platform within the organisations should democratise data by providing capability to slice and dice data based on one’s individual need.

Is there a solution to this?

The digital workforce needs to be trained in basic data management skills which can look at large internal and external data sets to generate insights. The digital worker is able to extract and perform basic transformations to make meaning from data sets.

This journey towards data driven decision making has to be done as part of the digital strategy of any organisation to revamp the data infrastructure. There are certain elements of culture which need to be tweaked to get the maximum benefit out of this capability. This building of a modern data platform will enable organisations to harness the power of new digital technologies like Artificial Intelligence and Machine Learning.

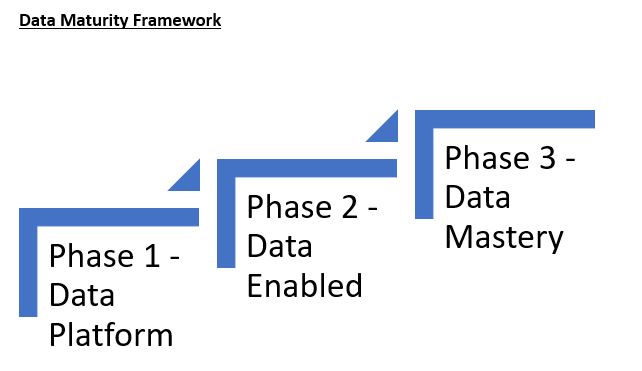

The below framework can help organisations in their digital maturity curve to build capability.

Can you explain more about phase one (creating an agile data platform?

This phase involves the creation of a data platform which democratises data by breaking silos. This phase is the most difficult as data pipelines need to be built to merge internal and external data. This is the longest phase of the journey as it involves analysing customer touchpoints and then looking at data elements which impact those touchpoints.

For a retailer this would involve the following data sets:

• Sales consolidated across various touchpoints

• Inventory fulfilment data across channels

• Customer buying pattern across various channels

• Customer feedback from internal channels as well as social listening

• Product data enrichment to customer feedback

The unification of data across various channels/functions has to happen with a 360-degree view of the customer.

What can you tell us about phase two (data enabled decision making)?

During this phase the organisation uses data to create customer journey and experiences with the use of data models. The decisions are still human driven but all those have been hypothesised using data models. This is achieved by building decision models using modern applications which still require human oversight for final execution.

The models in these phases are tested and refined for maturity. This requires transforming the organisation to test ideas and design digital business models in an agile way. This helps in building a culture of experimentation where few models fail but the agility limits the damage to learn from it and build a stronger model.

Finally, could you explain more about phase three (creating data mastery with advanced automated decisions?

This is a maturity level where organisations have established the use of data for most of their decision making. The Artificial Intelligence and Machine Learning models are fully tested and running on auto mode with limited intervention by humans.

This requires fully transforming to a pure digital enabled organisation where data is at the heart of all decisions which are mostly automated. The workforce is also transformed to build sophisticated models and enhance it using agile ways of development. The organisation is fully customer centric with metrics focusing on customer experience.

The ability of organisations to traverse through these maturity levels will depend on an ability to transform and adopt new ways of working and culture in the organisations. Most of the organisations have embarked on this journey of data maturity which will help in delivering a ‘wow’ customer experience. Most of the non-digital-native organisations are in phase one or at the cusp of phase one and two.

This advancement across phases will determine the winners and losers in the coming decade. Organisations have to start taking customer centricity more seriously to make CX their prime objective for enhancing the value.