There is no other industry today characterised by hyper-competition and massive disruption as much as telecommunications. At the forefront of unprecedented technology advancements like the metaverse, 5G, fibre optic, the Internet of Things, and more, telecoms sit poised to help drive new revenue streams not only for their own organisations, but also for many other industries.

As a result, telecoms are in a rush to deliver a richer customer experience, capitalise on new innovations, and gain more market share, all while seamlessly balancing varying types of work projects and activities despite a lack of skilled workers.

While companies across industries face common challenges when it comes to field service management, such as legacy technology systems, the global skills shortage, economic uncertainty and increasing customer demands, telco leaders ranked these pressures among the top three that will have the biggest impact on their service organisations in 2023:

- Increased regulatory requirements

- Outdated or insufficient service technologies

- Skilled labour shortage and high turnover

Oversight by government, industry and other regulators requires strict protocols and workflows across most business areas. Considerations include complying with public authorities that regulate the telecommunications industry, maintaining defined service levels with customers, the health and safety of workers, and environmental protection. These regulations force telcos to deploy customer engagement solutions, workflow automation, and data consolidation for real-time oversight and easier proof of compliance.

While this was ranked number one in our survey, the recent trend towards shared, open RAN, Radio Access Networks, and open API initiatives will certainly cause major shifts in industry regulations. Open RAN aims to achieve interoperability and standardisation of radio access network elements across various software and hardware providers.

This new shift towards collaboration among telecom operators is meant to help drive innovation, lower costs and build resilience against supply chain disruptions, all of which will help CSPs deliver more services to more B2B industries and to more of the world’s population. It will also help ensure that rural customers have access to the same services and network performance as urban customers.

Two of the lowest-ranking service management pressures faced by telcos were increased complexity of assets and service delivery. With the integration of cloud computing, artificial intelligence and machine learning in wireless cellular networks, complexity will rapidly increase, so these challenges could be heightened in the near future. Yet, the open RAN initiative that is being supported by more and more of the world’s leading telco brands is hoping to reduce this complexity by encouraging cooperation and communication across the industry.

Legacy infrastructure is acutely felt by telecom firms because it impedes the business from tapping into meaningful innovations and responding with agility to market changes and new customer demands. Replacing legacy systems with a future-proof service management platform that offers embedded innovations allows telcos to automate internal operations, leading to lower costs, higher workforce efficiencies, faster innovation and more streamlined service experiences.

Spurred partly by the shift to 5G networks, telcos are migrating to cloud-based platforms that can not only automate field service and asset management processes with AI and machine learning, but also seamlessly integrate multiple systems for a unified business view and faster data sharing across different business units.

Contributing factors behind the global skills shortage vary, including the gig economy’s rise during the pandemic, workers retiring early or aging out, and the rapid evolution of technology, specifically, 5G, shortening the list of qualified candidates. As a result, telcos are under increasing pressure to do more with less while providing a better user and employee experience.

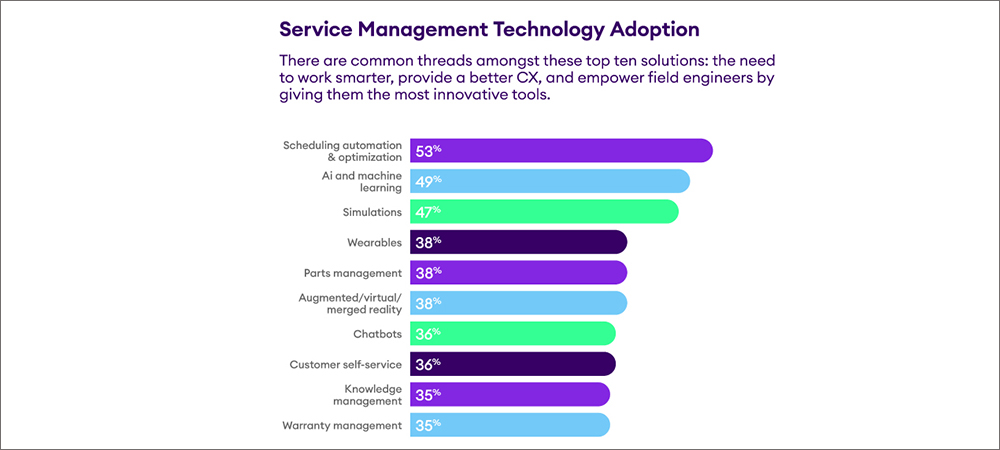

Many large telcos rely on workforce planning and scheduling optimisation technology to increase efficiencies across their existing employee base. By leveraging artificial intelligence, machine learning, real-time data, and automation, the technology handles repetitious administrative tasks and precise scheduling, freeing workers to focus on higher-value work while increasing productivity.

Some solutions even offer differentiated functionality such as ad hoc sourcing for parts that are unexpectedly needed for jobs and seamless integration of spare parts management so that technician schedules and parts delivery are optimised collaboratively, ensuring higher first-time fix rates.